In fact there is only one minor change which applies to the medical expenses and examination of the individual spouse or child. On the First 2500.

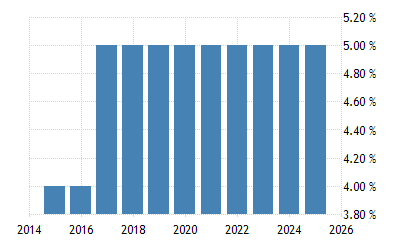

Corporation Tax Europe 2021 Statista

The decision on how much of the individual income tax revenue needed be paid are decided on every years budget meeting in Parliament.

. 10 rows Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT. Regarding the expatriates that qualify for tax residency Malaysia has a progressive personal income tax system in which the tax rate increases as an individuals income increases starting at 0 percent and capped at 28 percent. On the First 35000 Next 15000.

Masuzi October 20 2018 Uncategorized Leave a comment 3 Views. Income tax relief Malaysia 2018 vs 2017. Rate TaxRM 0 - 2500.

You can check on the tax rate accordingly. On the First 50000 Next 20000. On the First 10000 Next 10000.

Malaysia Personal Income Tax Rate. The income tax rates are on Chargeable Income not salary or total income and. Malaysia Personal Income Tax Rate.

The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent for chargeable income exceeding 2. On the First 5000 Next 15000. While the 2017 budget had several implications for personal income tax tax rates were unaffected from the previous year.

Tax Rate Table 2017 Malaysia masuzi October 18 2018 Uncategorized Leave a comment 4 Views Malaysia personal income tax rates malaysia personal income tax rates 2017 budget 2017 new personal tax rates for personal tax archives updates. Under the current legislation the income tax structure for resident individuals is based on progressive tax rates ranging from 0 to 28 on chargeable income. Singapore To Impose New Individual Income Tax Rates In 2017 Asean Business News Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years. Assessment Year 2017 Assessment Year. The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Malaysia Personal Income Tax Rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a max of 28. 13 rows 28.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. On the First 20000 Next 15000. Malaysia Personal Income Tax Rates Table 2017 Updates Budget Business News Malaysia.

Malaysia Personal Income Tax Rate 2017 Table. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Starting from year of assessment 2017 the lifestyle tax relief includes individual with a monthly income of RM3600 and above said Choong Hui Yan a tax consultant from SIMways.

Malaysia personal income tax rates individual income tax in malaysia for personal income tax rate. A non-resident individual is taxed at a flat rate of 30 on total taxable income. On the First 5000 Next 5000.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Income Slab Tax Rates For Ay 2018 19 Fy 2017 18 Income Tax Return Income Tax Tax Exemption

The Purpose And History Of Income Taxes St Louis Fed

Do You Need To File A Tax Return In 2018

Which U S Companies Have The Most Tax Havens Infographic

Asiapedia Iras 2017 Singapore Personal Income Tax Dezan Shira Associates

Eritrea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

Taxes From A To Z 2017 O Is For Over The Counter Medicines

Do You Need To File A Tax Return In 2018

Why Economists Love Property Taxes And You Don T Bloomberg

2018 2019 Malaysian Tax Booklet

Singapore To Impose New Individual Income Tax Rates In 2017 Asean Business News

The Zombie Claim That The 2017 Tax Cut Gave 83 Percent To The Top 1 Percent The Washington Post

P Cecilia I Will Provide Accounting And Tax Services Malaysia For 190 On Fiverr Com Accounting Services Tax Services Bookkeeping Services

Doing Business In The United States Federal Tax Issues Pwc